Nazareth - Saba:

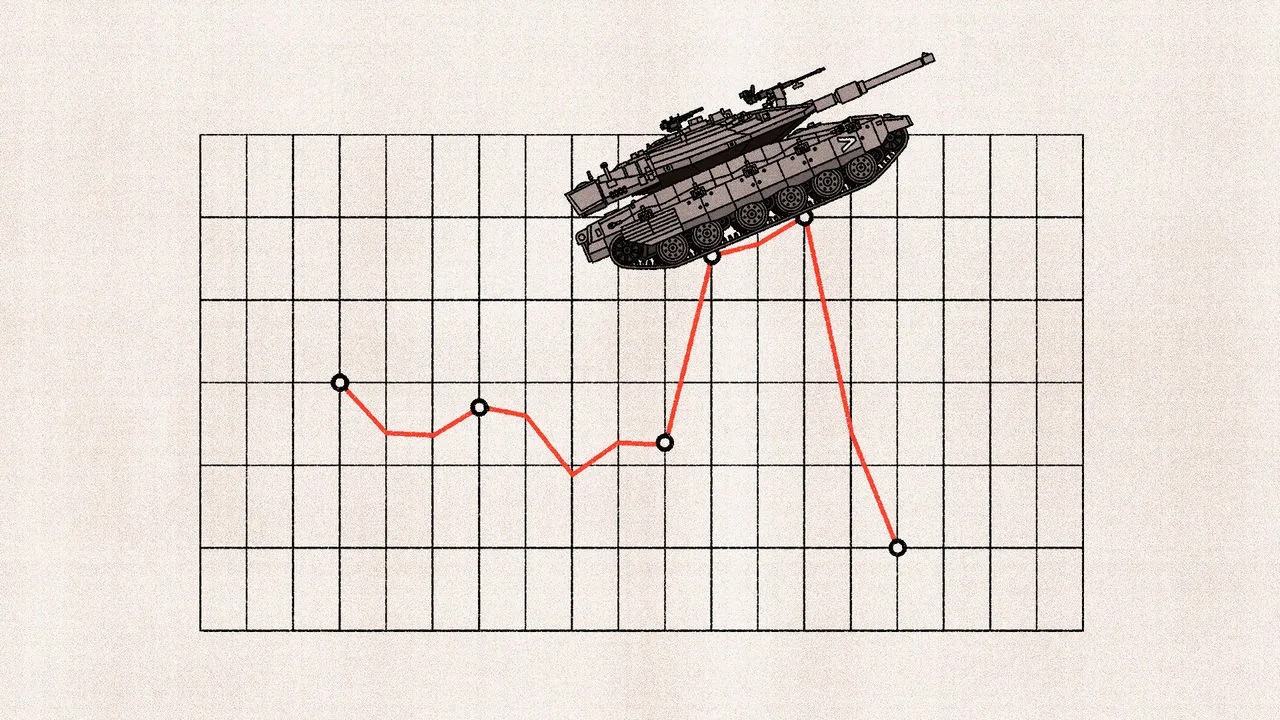

The Israeli economy is grappling with significant losses due to the ongoing conflict in the Gaza Strip and the government's poor financial management. Reports suggest that the economy is enduring an unprecedented recession that may persist for an extended period.

According to a report by the Israeli newspaper Haaretz on Tuesday, the economy has contracted by 1.5 percent since the onset of the war, highlighting its struggle to recover from the damages incurred during the initial weeks of conflict.

The report noted that the war has led to a notable decline in exports and investments, directly impacting the nation's GDP. Furthermore, major credit rating agencies—Moody's, Standard & Poor's, and Fitch—have downgraded Israel's credit rating, exacerbating economic challenges.

These downgrades stem from rising budget deficits and continued heavy expenditures related to the conflict. Standard & Poor's previously cautioned that the Israeli economy could see zero growth in 2024, with only a modest 2.2 percent growth projected for 2025—far below earlier forecasts.

Haaretz emphasized that one of the most significant economic repercussions of the war is the drastic increase in military spending. Estimates indicate that the conflict's costs have soared into the billions, driven by heightened expenses for fuel and military supplies.

The report cited mismanagement in financial policies, highlighting that the Israeli Electric Company spent hundreds of millions of shekels on diesel to ensure energy supplies during emergencies, severely impacting its financial performance.

While acknowledging the importance of the electricity sector to the Israeli economy, the high costs are expected to burden its budget for years. The report also mentioned anticipated expenses for rebuilding settlements near the Gaza Strip that suffered extensive damage during the initial stages of Operation al-Aqsa Flood.

Some of these costs may be offset by international aid, but the primary burden will fall on an already weakened economy. With the credit rating downgrade, the government faces challenges in securing loans at reasonable interest rates.

Haaretz concluded that this situation directly impacts the government's ability to finance reconstruction efforts or manage the growing budget deficit, projected to reach record levels in 2025 due to military spending and humanitarian aid needs. Economists argue that the financial toll of the war could have been less severe with better decision-making, suggesting that more realistic military objectives might have shortened the conflict.

The Israeli economy is grappling with significant losses due to the ongoing conflict in the Gaza Strip and the government's poor financial management. Reports suggest that the economy is enduring an unprecedented recession that may persist for an extended period.

According to a report by the Israeli newspaper Haaretz on Tuesday, the economy has contracted by 1.5 percent since the onset of the war, highlighting its struggle to recover from the damages incurred during the initial weeks of conflict.

The report noted that the war has led to a notable decline in exports and investments, directly impacting the nation's GDP. Furthermore, major credit rating agencies—Moody's, Standard & Poor's, and Fitch—have downgraded Israel's credit rating, exacerbating economic challenges.

These downgrades stem from rising budget deficits and continued heavy expenditures related to the conflict. Standard & Poor's previously cautioned that the Israeli economy could see zero growth in 2024, with only a modest 2.2 percent growth projected for 2025—far below earlier forecasts.

Haaretz emphasized that one of the most significant economic repercussions of the war is the drastic increase in military spending. Estimates indicate that the conflict's costs have soared into the billions, driven by heightened expenses for fuel and military supplies.

The report cited mismanagement in financial policies, highlighting that the Israeli Electric Company spent hundreds of millions of shekels on diesel to ensure energy supplies during emergencies, severely impacting its financial performance.

While acknowledging the importance of the electricity sector to the Israeli economy, the high costs are expected to burden its budget for years. The report also mentioned anticipated expenses for rebuilding settlements near the Gaza Strip that suffered extensive damage during the initial stages of Operation al-Aqsa Flood.

Some of these costs may be offset by international aid, but the primary burden will fall on an already weakened economy. With the credit rating downgrade, the government faces challenges in securing loans at reasonable interest rates.

Haaretz concluded that this situation directly impacts the government's ability to finance reconstruction efforts or manage the growing budget deficit, projected to reach record levels in 2025 due to military spending and humanitarian aid needs. Economists argue that the financial toll of the war could have been less severe with better decision-making, suggesting that more realistic military objectives might have shortened the conflict.